Thrift McLemore Salutes Our Troops And Celebrates Our Veterans!

Memorial Day is about more than bathing suits, beaches and barbecues. It’s about remembering the brave men and women who gave their all for our country, and asking ...

Memorial Day is about more than bathing suits, beaches and barbecues. It’s about remembering the brave men and women who gave their all for our country, and asking ...

Solis Two Porsche Drive hotel and Apron restaurant are going the extra mile with their menu offerings for dogs flying the friendly skies. Porsche’s posh Solis Two Po ...

Even though the buyer of the recreational vehicle described it as a “jalopy,” the 7th Circuit of Appeals found the warranty was built solidly enough to prevent the ma ...

Atlanta has no lack of pet-friendly facilities. Below is a list of such institutions, carefully groomed to our exacting standards. At long last, the rewards for the c ...

As we celebrate America’s Independence Day, we also salute our troops and thank veterans for their service. We also recognize that disabled veterans need to know ...

The National Automotive Finance Association’s 22nd Annual Non-Prime Auto Financing Conference will be held May 30 – June 1, 2018, at the Omni Fort Worth Hotel. This ...

Credit: Recreation Vehicle Industry Association RV shipments for 2017 totaled 504,599 units, an increase of 17.2% compared to 2016. The growth this year makes eigh ...

Thrift McLemore is to pleased to announce that we have received the Martindale-Hubbell Gold Client Champion Award. The Martindale-Hubbell Gold Client Champi ...

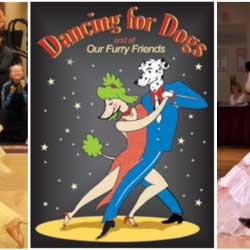

Thrift McLemore is excited about the upcoming second annual Dancing for Dogs fundraiser for the Georgia Pet Coalition! It is a great opportunity to raise funds for pe ...